Hanging Orders¶

This feature keeps orders "hanging" (or not cancelled and remaining on the order book) if a matching order has been filled on the other side of the order book (bid vs. ask order books).

Configuration variables¶

hanging_orders_enabled¶

When enabled, the orders on the side opposite to the filled orders remains active.

** Prompt: **

hanging_orders_cancel_pct¶

Cancels the hanging orders when their spread goes above this value. Note that no other parameter can cancel hanging orders other than hanging_orders_cancel_pct.

** Prompt: **

How it works¶

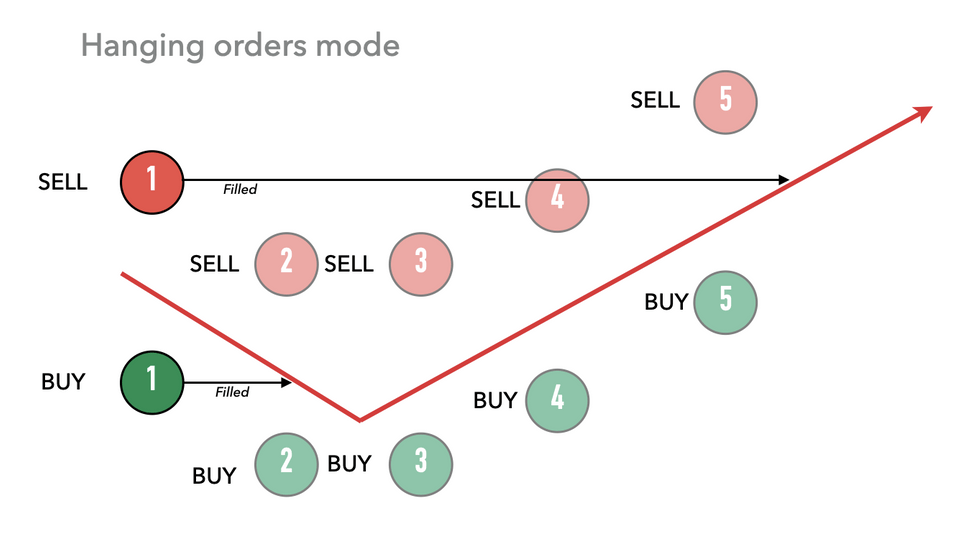

Hanging orders is a function that instructs Hummingbot to treat buys and sells of the same order as a pair. If one side gets filled, the bot keeps the other side of the pairing, creating the possibility of that side to eventually get filled:

In the example above, the buy order for the first pair was filled. But since hanging orders mode was enabled, the original sell order from the first pair is not cancelled during the refresh cycle (period 2) and remains outstanding. Meanwhile, the bot continues to create new orders (see periods 2 through 5). In the example, prices changed direction and eventually at some point, the hanging sell order was filled around period 5.

The benefit of this strategy is that it creates the possibility of the pairings to be “completed” and balanced.

Typically, orders are placed as pairs in single order mode (1 buy and 1 sell order), and when a buy or sell order is filled, the other order is cancelled. The parameter hanging_orders_enabled allows Hummingbot to leave the order on the other side hanging (not cancelled) whenever one side is filled.

The hanging order will be cancelled in the following conditions:

- The spread goes above the specified

hanging_orders_cancel_pctvalue - Sending

stoporexitcommand

Type config hanging_orders_enabled and config hanging_orders_cancel_pct to set values for these parameters.

Illustrative examples - when hanging orders are important¶

Example 1 (basic)¶

Suppose you are market making for the ETH-USDT pair with a mid-market price of 200 USD (\(t_0\)). You set your bid spread and ask spread to 1%. Thus, the bid price is 198 USD and the ask price is 202 USD.

Now suppose that a market taker (someone taking a position in the market) thinks the price of Ethereum will rise, so they fill your ask order 202 (\(t_1\)).

At the next order refresh cycle, normally Hummingbot would cancel the 198 USD bid order and create 2 new bid and ask orders. However, if hanging_orders_enabled is set to True, the bid order is not cancelled and stays on the order book until it is filled. Note that if an open hanging order spread exceeds the hanging_orders_cancel_pct parameter, the hanging order will be canceled.

Example 2 (advanced)¶

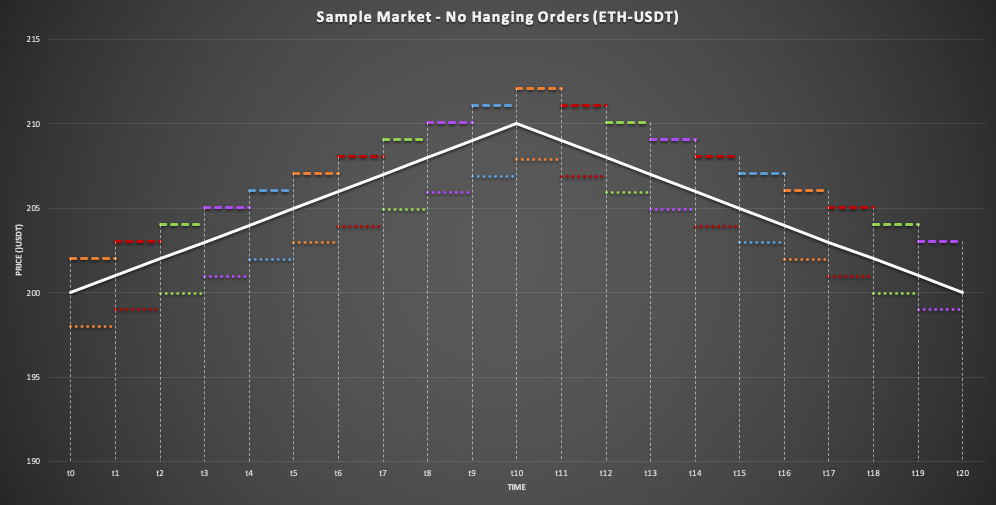

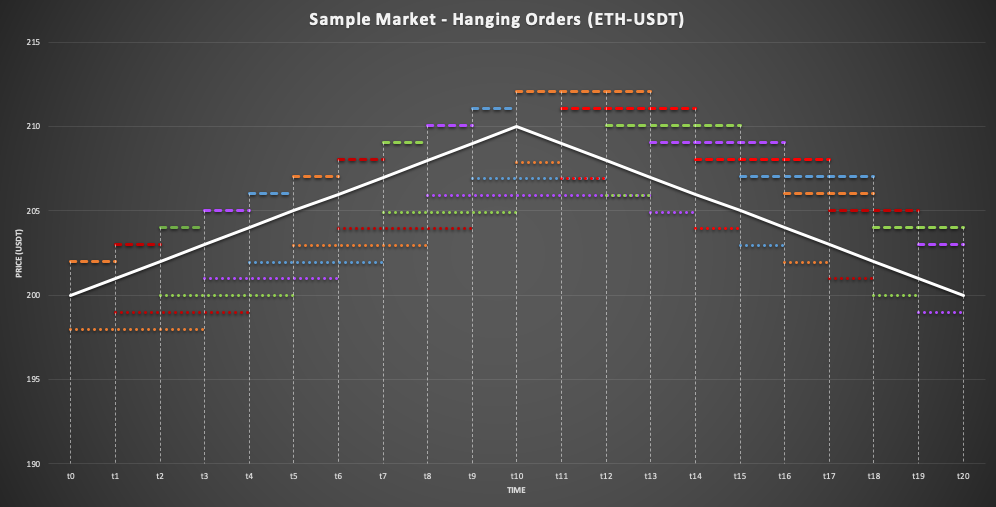

Suppose that you are again market making for ETH-USDT pair. The bid and ask spread is set to 1%. Consider the two strategies below, the former the default and the latter with hanging orders. The white line in the center is the mid market price in USDT; The dashed lines above the mid-market price are the active ask-orders; And the dotted lines below the mid-market price are the active bid-orders.

Market Without Hanging Orders¶

In this strategy, the hanging_orders_enabled parameter is False. At each interval \(t_i\), the order is either cancelled or filled, then refreshed with a new set of bid and ask orders (each with a 1% spread from the mid-market price). There are only two orders at a time, an ask order and a bid order. This is a great strategy as a default, however, price takers need to be willing to fill orders relatively close to your chosen spread. It may require you to tighten your spread to get more price takers to fill your orders.

Market With Hanging Orders¶

In this strategy, the hanging_orders_enabled parameter is True. We set the hanging_orders_cancel_pct parameter to 2% and make the assumption that an order is filled by a market-taker if the spread is within 0.55%. When a bid order is filled or canceled, unlike the default, the ask order is left open. Similarly, when a ask order is filled or cancelled, the bid order is left open. As you can see above, from \(t_0\) to \(t_{10}\) generally the bid orders are "hanging" until their spreads are greater than 2% from the mid-market price line (or are filled). From \(t_0\) to \(t_{10}\), the ask orders are being filled as they fall within 0.55% of spread to the mid-market price line. The opposite is true from \(t_{10}\) to \(t_{20}\), where bid orders are being filled as they fall within 0.55% of the spread to the mid-market price line and the ask orders are "hanging" until they are cancelled when their spreads are greater than 2%.

This strategy allows for a range of spreads between the cancel percentage parameter and when a price taker fills your order (presumably when the order price is closer to the mid-market price). It is ultimately a more flexible strategy and can capture profitable trades that are lost without hanging orders. For example, in the Sample Markets above, the purple bid order starting at \(t_8\) is lost without allowing it to be a hanging order, whereas in the second chart, the bid order is filled at \(t_{13}\).

Sample Configurations¶

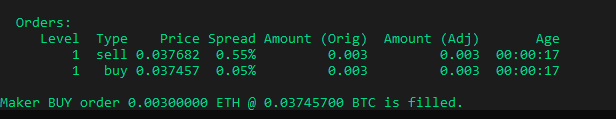

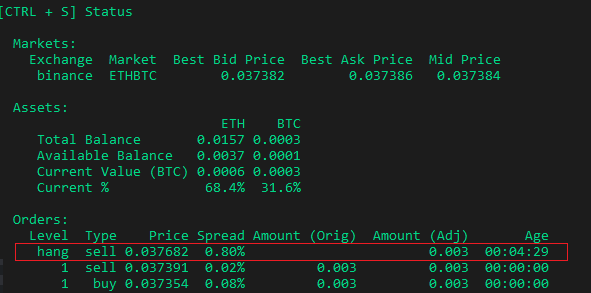

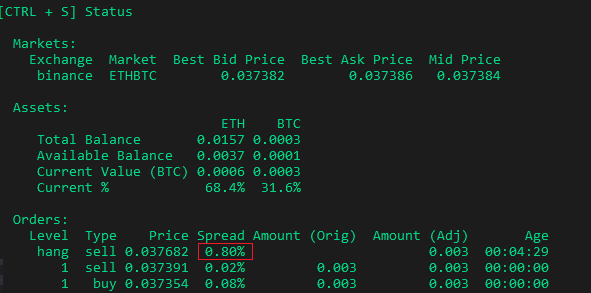

Let's see how this configuration works in the scenario below:

When the buy order was completely filled, it will not cancel the sell order. After 60 seconds, Hummingbot will create a new set of buy and sell orders. The status output will show all active orders while indicating which orders are hanging.

The hanging order will stay outstanding and will be cancelled if its spread goes above 2% as specified in our hanging_orders_cancel_pct.

Hanging Orders with Multiple Order Levels¶

When an order is filled on one side either buy or sell, all active orders on the opposite side are left hanging.

With the sample configuration above, the bot places 3 buy and 3 sell orders.

Orders:

Level Type Price Spread Amount (Orig) Amount (Adj) Age

3 sell 239.75 2.49% 0.05 0.05 00:00:01

2 sell 237.41 1.49% 0.05 0.05 00:00:01

1 sell 235.07 0.49% 0.05 0.05 00:00:01

1 buy 233.9 0.01% 0.05 0.05 00:00:01

2 buy 231.56 1.01% 0.05 0.05 00:00:01

3 buy 229.22 2.01% 0.05 0.05 00:00:01

Buy order 1 gets filled.

This leaves the 3 sell orders hanging on top of the new orders on the next refresh.

Orders:

Level Type Price Spread Amount (Orig) Amount (Adj) Age

hang sell 239.75 2.50% 0.05 00:01:08

3 sell 239.73 2.49% 0.05 0.05 00:00:01

hang sell 237.41 1.50% 0.05 00:01:08

2 sell 237.39 1.49% 0.05 0.05 00:00:01

hang sell 235.07 0.50% 0.05 00:01:08

1 sell 235.05 0.49% 0.05 0.05 00:00:01

1 buy 233.88 0.01% 0.05 0.05 00:00:01

2 buy 231.54 1.01% 0.05 0.05 00:00:01

3 buy 229.2 2.01% 0.05 0.05 00:00:01

HangingOrdersTracker¶

This section provides a developer-oriented overview of the

HangingOrdersTracker

helper class designed to assist strategies with managing hanging orders. It automates

a large part of the process, including renewing outdated orders and cancelling orders that have drifted too far from

the market price.

Two examples of its usage can be found in the

PureMarketMakingStrategy

and the AvellanedaMarketMakingStrategy

strategies.

Fundamental Concepts¶

An important fundamental concept to be aware of is that the tracker operates by maintaining a list of candidate

hanging orders. This article will refer to that list as "the candidate list". Calling the

update_strategy_orders_with_equivalent_orders method will perform a check that the candidate list is synchronized

with the orders on the exchange and will effectively start tracking the hanging orders.

The most basic set of methods are the add_order and remove_order which respectively add and remove orders from the

candidate list of hanging orders. However, the add_order function is most likely to be used in the initialization

of the strategy, when hanging orders are retrieved from the database and registered with the tracker, while the

remove_order function may not have to be used at all as the responsibility of removing tracked hanging orders is

transferred to the tracker and automated away.

Registering the Tracker¶

During the initialization phase, the HangingOrdersTracker must be registered with the connectors used by

the strategy in order to receive updates about the orders and perform its responsibilities. This is achieved by simply

calling the register_events method and passing a list of the relevant connectors. When the strategy is being stopped,

the tracker's unregister_events must be called to gracefully deregister the tracker from the connectors.

Hanging Orders Creation Flow¶

When creating new orders, use the method aptly named add_current_pairs_of_proposal_orders_executed_by_strategy

to register the order pairs by passing them in as CreatedPairOfOrders. The tracker then starts listening for filled

orders and updates the pairs accordingly.

Once the current cycle is over and the strategy is about to cancel the current orders and replace them with a new set,

calling update_strategy_orders_with_equivalent_orders will detect hanging orders from the currently active

CreatedPairOrders and add them to the candidate orders list. Subsequently, as mentioned in the

Fundamental Concepts section, calling theupdate_strategy_orders_with_equivalent_orders method

will ensure the integrity of the candidate orders list and start tracking the hanging orders.

After this step is performed, the strategy can proceed to cancelling the orders it wants to cancel as part of the

current cycle termination process. It simply needs to ask the tracker if a given order is a hanging order by calling the

is_order_id_in_hanging_orders method. If it is, the strategy doesn't need to worry about that order anymore. If it's

not, then the strategy can proceed to cancelling it.

The Management Process¶

Finally, for the tracker to perform its tasks, the process_tick method must be called on every strategy tick. When the

method is called, the HangingOrdersTracker performs two tasks: first, it removes hanging orders with

extreme spreads; second, it renews orders that have passed

the max order age. To enable renewing old orders, the strategy must implement the

max_order_age attribute.