Performance History¶

History command¶

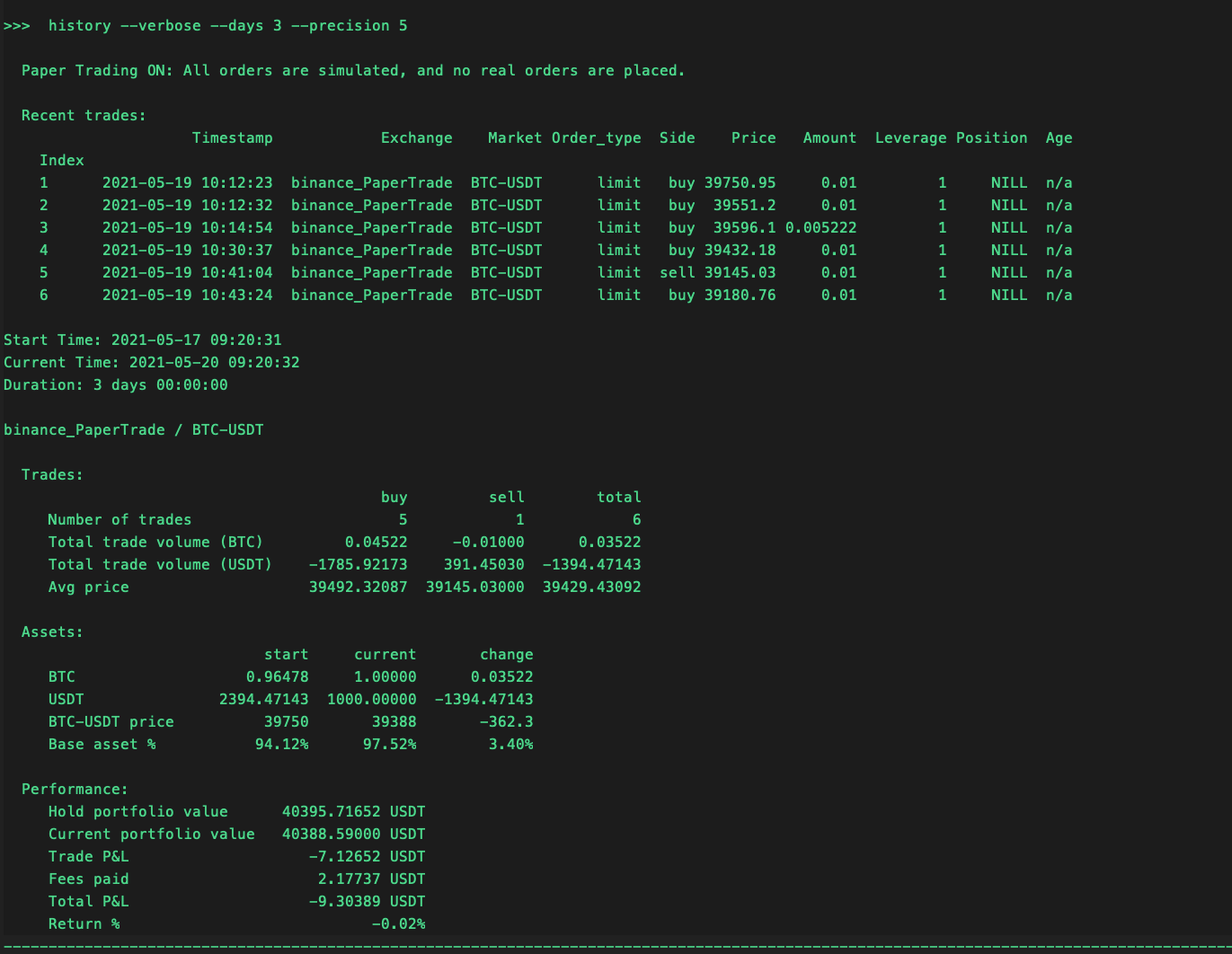

The history command displays the current duration of total past trades, asset inventory and value, and market trading pair performance. Run history --verbose to see all recent trades.

Trades are saved locally in a .csv file located in the data folder which you can view by running history --verbose --days command even after you restart Hummingbot.

Optional argument --precision specifies the number of decimal values.

This block below shows the calculation for some of the values displayed in the history output.

Avg price = total trade volume of quote / total trade volume of base asset

Hold portfolio value = (base start asset * current market price) + quote start asset

Current portfolio value = (base current asset * current market price) + quote current asset

Trade P&L = current portfolio value - hold portfolio value

Total P&L = trade P&L + fees paid

Return % = total P&L / hold portfolio value

Tip

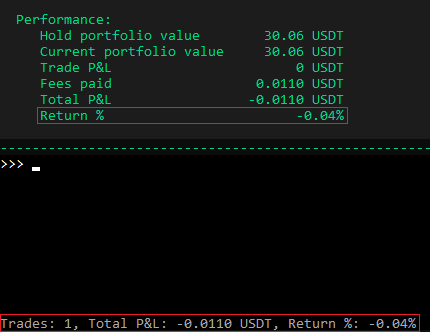

The Return % in the navbar at the bottom of Hummingbot client may be different from the history command output. This is because the Return % in history takes the price changes into calculation while the navbar in the bottom UI does not.

How It Works¶

Run the history command in Hummingbot to display the current duration of total past trades, asset inventory and value, market trading pair performance.

Sample Output¶

>>> history

Start Time: 2020-11-11 00:56:37

Current Time: 2020-11-11 12:57:22

Duration: 0 days 12:00:45

binance / MFT-BNB

Trades:

buy sell total

Number of trades 113 97 209

Total trade volume (BTC) 2181335 -2133912 47423

Total trade volume (USDT) -217,67 210.76 -6.91

Avg price 0.0000998 0.0000988 0.0001457

Assets:

Start Current Change

MFT 155248 202671 47423

BNB 23.331 16.419 -6.912

MFT/BNB price 0.0001076 0.0000809 -0.0000267

Base asset % 41.7% 50.0% 8.2%

Performance:

Hold portfolio value 35.890 BNB

Current portfolio value 32.815 BNB

Trade P&L -3.075 BNB

Fees paid -0.428 BNB

Total P&L -3.504 BNB

Return %: -9.76%

The following displays the formula for key calculations:

Note

For more details on the calculations, please see this Google Sheet.

Average Price¶

Avg Price = Total trade volume of quote/Total trade volume of base asset.

In the sample output, the total avg price is 6.91/47423 = 0.0001457

This value means the average price of total MFT/BNB trades is 0.0001457

Hold Portfolio Value¶

The asset value from the start to the end with no trades.

Hold portfolio value = (base start asset*current market price)+ quote start asset

From the above example, for the Hold portfolio value is (155248*0.0000809)+23.33=35.89

Current Portfolio Value¶

Current portfolio value = (base current asset*current market price)+ quote current asset

From the above example, for the Current portfolio value is (202671*0.0000809)+16.419=32.815

Trade P&L¶

Trade P&L = Current portfolio value - Hold Portfolio value

From the above example, for the Trade P&L value is 32.815-35.89=-3.075

Total P&L¶

Total P&L = Trade P&L + Fees paid

From the above example, for the Total P&L is -3.075 + -0.428 = -3.504

Return Percentage¶

Return% = Total P&L/Hold portfolio value

From the above example, for the Return% is -3.075/-35.89 = -9.76%

The Return % (bottom navbar) matches the calculated return on History after the last trade, see following screenshot: