amm_v3_lp¶

📁 Strategy Info¶

- Folder: /hummingbot/strategy/amm_v3_lp

- Configs: amm_v3_lp_config_map.py

- Maintainer: Hummingbot Foundation

📝 Summary¶

This strategy creates and maintains positions on AMMs that support liquidity ranges, such as Uniswap V3, as the market price changes in order to continue providing liquidity. Currently, it does not remove or update positions.

Note

This is a proof-of-concept strategy that demonstrates how to dynamically maintain Uniswap-V3 positions as market prices changes. More features will be added over time based on community feedback.

🏦 Exchanges supported¶

🛠️ Strategy configs¶

| Parameter | Type | Default | Prompt New? | Prompt |

|---|---|---|---|---|

market |

string | True | Enter the trading pair you would like to provide liquidity on [connector] | |

fee_tier |

string | True | On which fee tier do you want to provide liquidity on? (LOW/MEDIUM/HIGH) | |

buy_spread |

decimal | 1.00 | True | How far away from the mid price do you want to place the buy position? (Enter 1 to indicate 1%) |

sell_spread |

decimal | 1.00 | True | How far away from the mid price do you want to place the sell position? (Enter 1 to indicate 1%) |

base_token_amount |

decimal | True | How much of your base token do you want to use for the buy position? | |

quote_token_amount |

decimal | True | How much of your quote token do you want to use for the sell position? | |

min_profitability |

decimal | True | What is the minimum profitability for each position is be adjusted? (Enter 1 to indicate 1%) | |

use_volatility |

bool | False | False | Do you want to use price volatility to adjust spreads? (Yes/No) |

volatility_period |

int | 1 | False | Enter how long (in hours) do you want to use for price volatility calculation |

volatility_factor |

decimal | 1.00 | False | Enter the multiplier applied to price volatility |

📓 Description¶

Approximation only

The description below is a general approximation of this strategy. Please inspect the strategy code in Trading Logic above to understand exactly how it works.

Starting¶

- The bot will look for information about the pool, and if it is a valid pool. If the pool doesn't exist, warn the user and stop the strategy

- Fetch the current mid price of the pool (

last_price) - If

use_volatilityis True, the bot will calculate the price volatility used to widen spreads - If the pool is valid, the bot will create two starting positions:

- The SELL position with:

- Amount of tokens added to the position =

base_token_amount upper_price=(1 + sell_spread) * last_pricelower_price=last_price

- Amount of tokens added to the position =

- The BUY position with:

- Amount of tokens added to the position =

quote_token_amount upper_price=last_pricelower_price=(1 - buy_spread) * last_price

- Amount of tokens added to the position =

- The SELL position with:

The bot maintains a variable total_position_range that defines the total price range, comprised of upper_price and lower_price, where the bot is providing liquidity.

Running¶

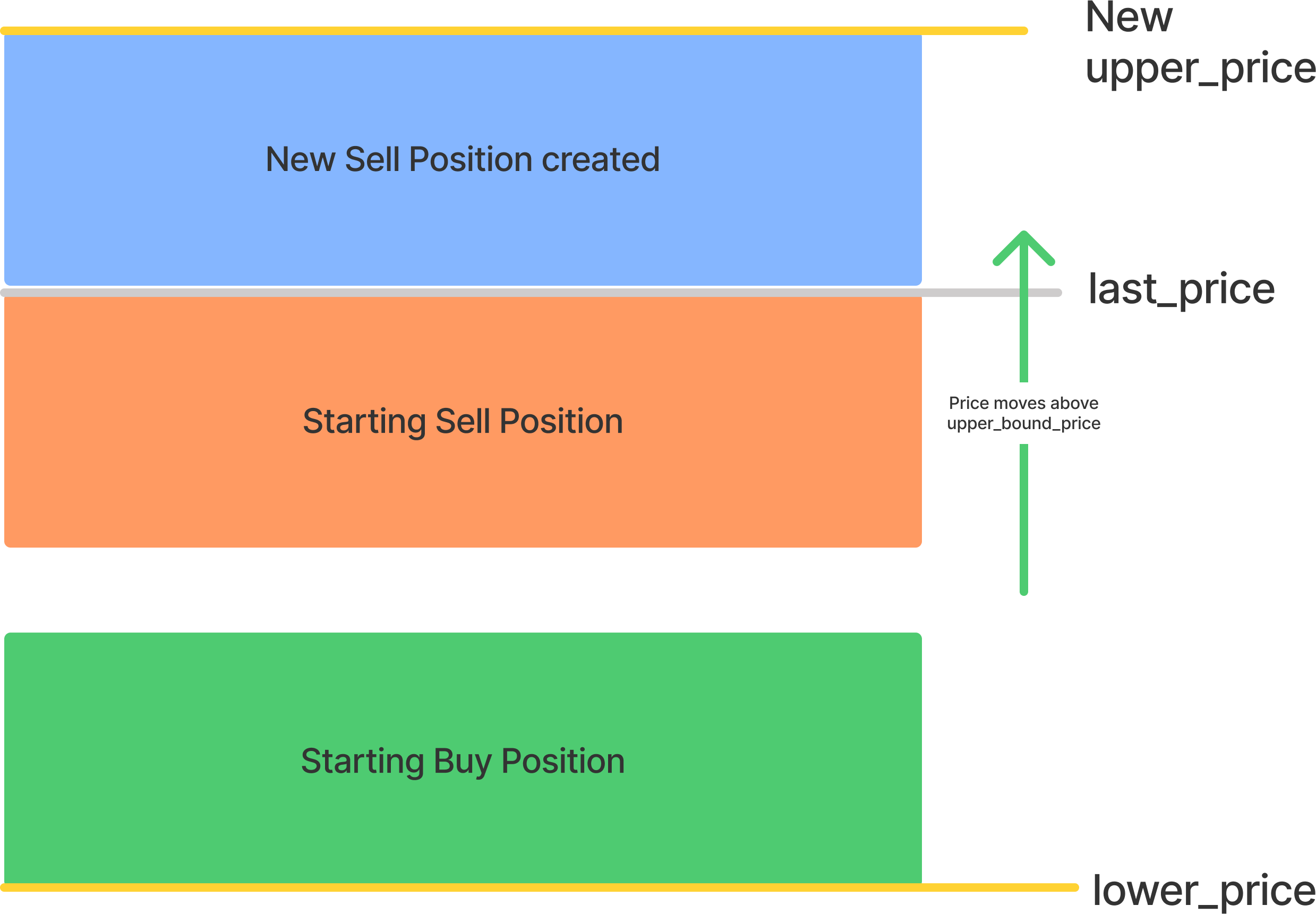

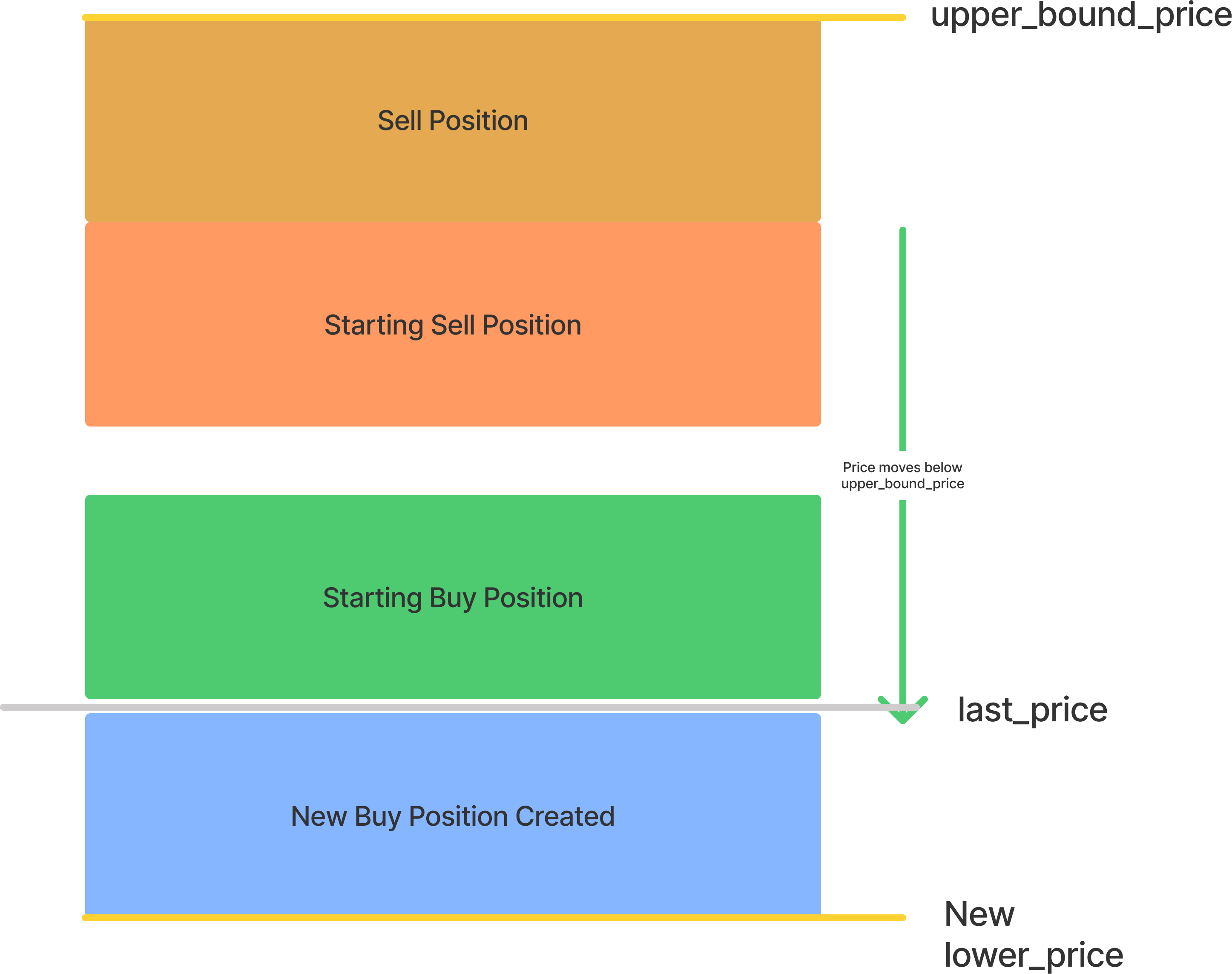

Each tick, the bot monitors the pool mid price (last_price) and compare it to the bounds of total_position_range. It will adjust the position under the following scenarios:

last_price is higher than upper_price of total_position_range

- Create a new SELL liquidity position, using the following values:

- Amount of tokens of the new position =

base_token_amount - Top price bound =

(1 + sell_spread) * last_price - Lower price bound =

last_price

- Amount of tokens of the new position =

- Update

total_position_range:upper_price = (1 + sell_spread) * last_price

last_price is lower than lower_price of total_position_range

- Create a new BUY liquidity position, using the following values:

- Amount of tokens of the new position =

quote_token_amount - New position upper price =

last_price - New position lower price =

(1 - buy_spread) * last_price

- Amount of tokens of the new position =

- Update

total_position_range:lower_price = (1 - buy_spread) * last_price

Important Notes¶

- Currently, the strategy does not remove existing positions. The user should do it manually through the Uniswap interace (https://app.uniswap.org/#/pool).

- The

statuscommand shows the current profitability of each position, using thequoteasset as reference

ℹ️ More Resources¶

AMM V3 strategy preview | Hummingbot Live: Demo of the latest iteration of the AMM V3 strategy